As the new Reconsideration of Value (ROV) regulations reshape the mortgage industry, lenders and Appraisal Management Companies (AMCs) alike face the challenge of aligning their processes with stringent compliance standards. Ensuring that these processes not only meet regulatory requirements but also enhance operational efficiency and maintain borrower trust is critical. ValueLink Software offers a comprehensive solution that simplifies ROV compliance while empowering you to excel in this evolving landscape.

ValueLink Software is designed with flexibility and ease of use in mind, making the ROV process straightforward for both Lenders and AMCs. With ValueLink, you can effortlessly navigate the complexities of the ROV process, ensuring that every request is handled with precision and care.

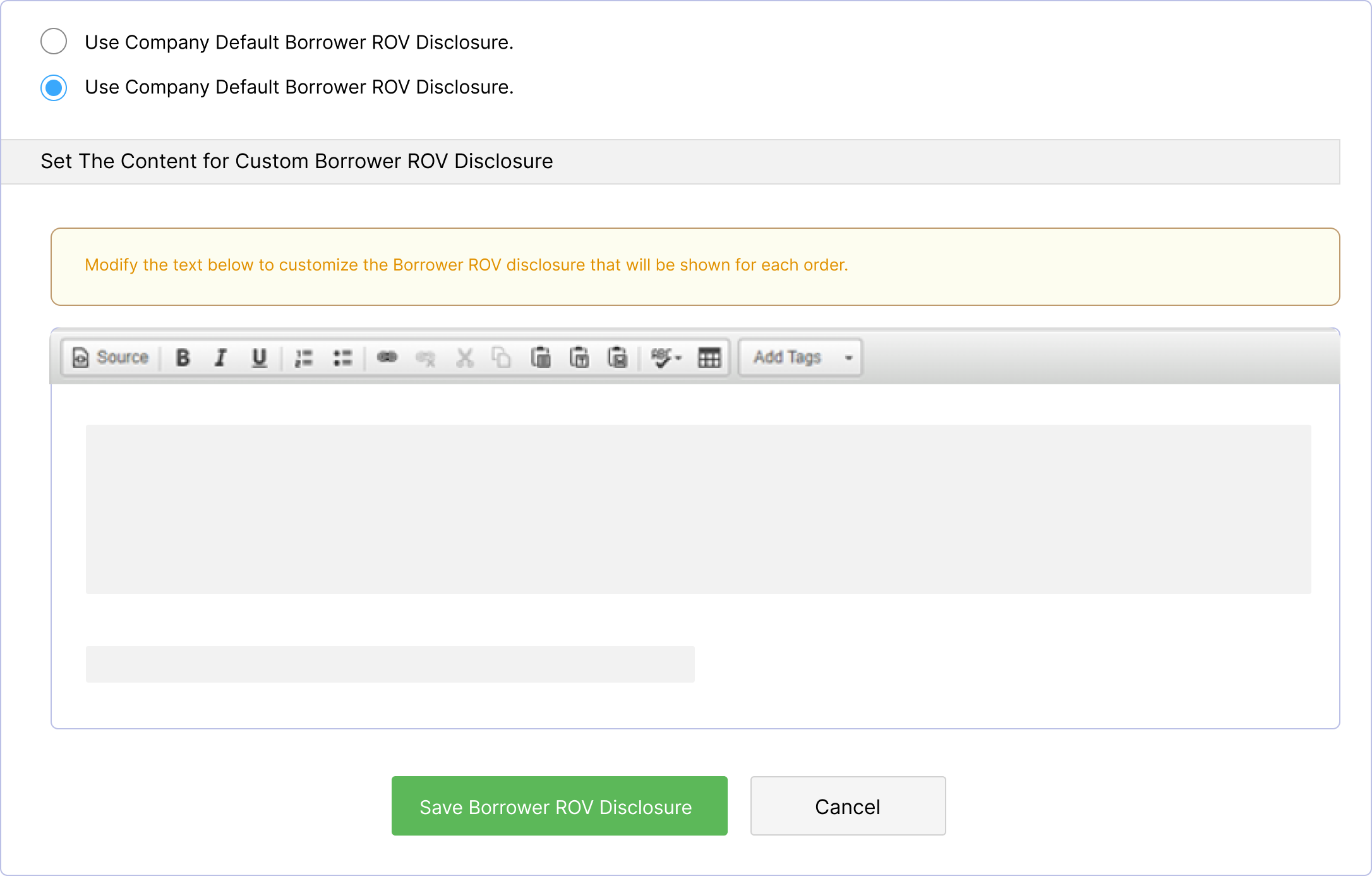

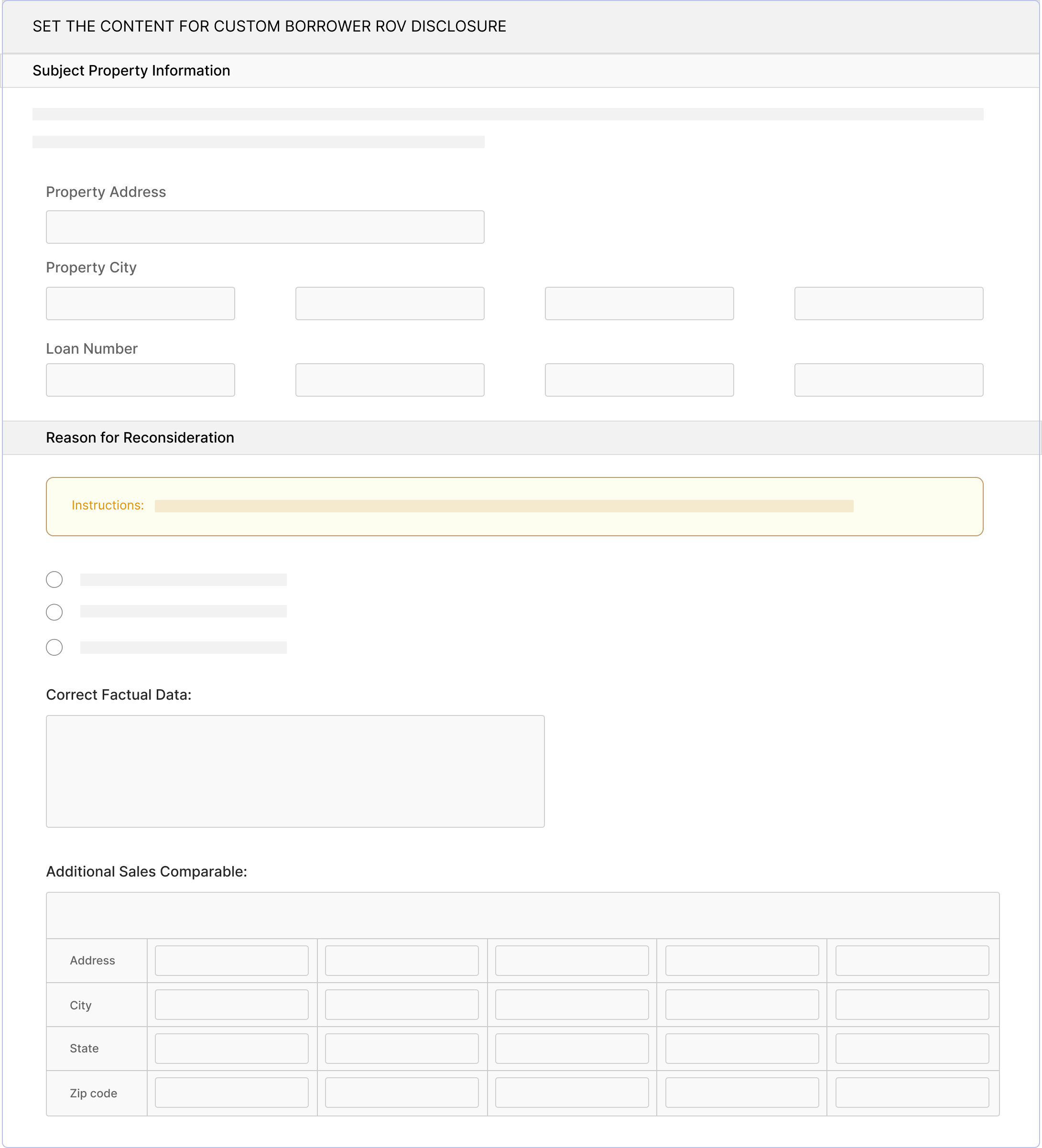

One of the key features of ValueLink is its ability to customize and automate disclosures. We understand that communication is critical in the ROV process, which is why our platform enables you to tailor notifications and disclosures to meet specific client needs. Whether you’re informing borrowers of their rights or updating vendors on the status of an ROV request, ValueLink ensures that all parties receive timely, accurate information, keeping everyone aligned and informed.

ValueLink simplifies the ROV workflow, making it easy to process, review, and respond to requests. Our platform includes a built-in ROV form that captures all essential details required for compliance or the flexibility to use your own ROV form. With features like automated vendor notifications, ValueLink helps reduce manual intervention, minimize errors, and accelerate the overall ROV process.

In an industry where compliance is paramount, ValueLink provides the tools you need to ensure that every action taken during the ROV process is documented and in line with regulatory standards. Our advanced reporting capabilities give you clear insights into your ROV operations, allowing you to track performance, identify areas for improvement, and maintain a comprehensive audit trail. With ValueLink, you can be confident that your ROV processes are not only compliant but also optimized for success.

At the heart of our ROV solution is a commitment to improving the relationships you have with your borrowers and vendors. By providing a transparent, efficient, and reliable ROV process, ValueLink helps you build trust and foster long-term partnerships. Our user-friendly interface ensures that all stakeholders have a seamless experience, from the initial ROV request to the final resolution.

ValueLink Software is more than just a tool—it’s your partner in navigating the new ROV regulations. Our platform is designed to take the complexity out of compliance, giving you the power to manage the ROV process with confidence and ease. With ValueLink, you can focus on what matters most: delivering exceptional service to your clients while staying ahead in a competitive market.

Ready to see how ValueLink can help? Explore our tailored solutions:

Enhance your order management workflow for swift and precise appraisal deliveries.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.