ValueLink helps Lenders close loans faster, reduce compliance risk, and deliver a better borrower experience, all in one connected ecosystem.

Reduction in your turnaround times (YoY)

Automation of the valuation process

by managing your appraisal process, so you can focus on growing your ROI.

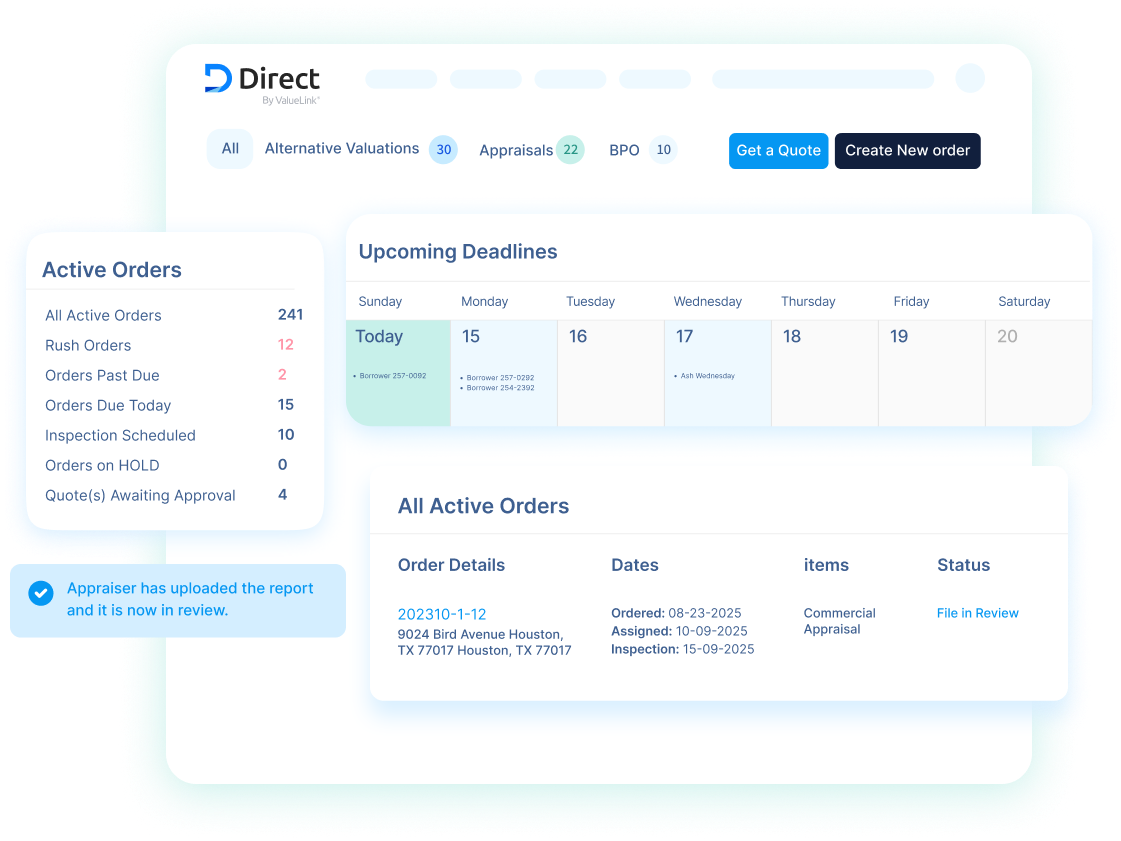

Launch faster with plug-and-play integrations to 20+ loan origination systems (LOS) & Ordering Platforms like Encompass & Byte.

Eliminate workflow breaks with real-time data sync across all systems in familiar environments.

Recruit and manage your panel, onboard new vendors, or find off-panel talent in minutes and automate order assignments.

Get instant fee estimates using our bidding feature or Cogent, our data tool that pinpoints exact vendor rates by location.

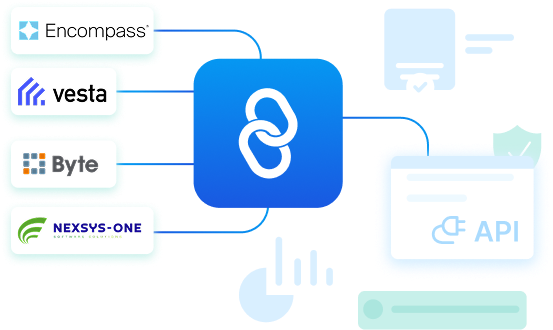

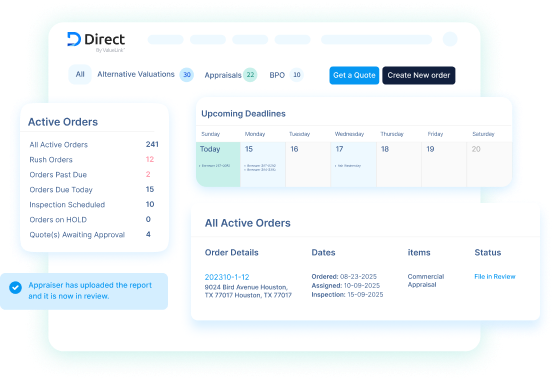

Know everything instantly with automated order updates and customized dashboards for every user, keeping Lenders, AMCs, and vendors perfectly synced.

Every report auto-submits to UCDP/EAD with guaranteed SSR compliance for Freddie & Fannie. Plus: AI powered CrossCheck ensures every report is airtight before submission.

Shows basic order status information.

Complete order tracking and communication capability that updates all parties in real time, even on mobile.

Works with a few common software systems.

Connects easily with most LOS/Order management platforms and allows custom integrations.

Covers costs if defective appraisals get through review.

Catches potential problems before appraisals are submitted.integrations.

Shows basic order status information.

Limited integrations with a few common platforms.

Flags issues only after an appraisal is submitted, leaving Lenders to cover costly mistakes.

Complete order tracking and communication capability that updates all parties in real time, even on mobile.

Prevents errors upfront with automated QC, ensuring defective appraisals never reach review.

“We really liked the system overall — especially the seamless integration with Encompass, the level of control we have on assignments, and the reporting tools. It’s a significant step up from how we used to manage things manually.”

“Best in Class!

ValueLink Software has been my go-to for 3 years. & I’ll continue to use them! With multiple industry awards, their stellar support team, including Partnership Manager Mansoor Khan, ensures a seamless experience. Exceptional service & cutting-edge solutions!

10 out of 10!”

“The ValueLink EPC integration has improved our overall appraisal workflow. It provides flexibility to map incoming forms to our eFolder documents allowing us to keep the eFolder organized. With the field mapping option, you can easily map custom or standard Encompass fields to and from ValueLink.”

“ValueLink's solutions have been instrumental in transforming our loan processing operations. We've seen a remarkable improvement in efficiency, accuracy, and most importantly, the satisfaction of our clients.”

“Switching to a new & more modern cloud-based valuation solution that provides new workflows for us to analyze and drive better outcomes, automates our entire valuation process, and simplifies technology through integration is important to maintaining GMM’s high standards across our branches countrywide.”

“Valuelink has been an excellent Appraisal Management System meeting our needs as a lender who manages their own panel of appraisers and engages appraisers directly. The system has robust features and functionalities that align with business operations and compliance.”

Love this program!

Yes. ValueLink’s Insights dashboard delivers business-level visibility across your entire valuation workflow. Monitor key metrics like order volume, average turn time, revision frequency, vendor performance, and client activity. Filter by branch, region, loan type, or date range to uncover trends, pinpoint bottlenecks, and benchmark performance. With custom scorecards and an intuitive Report Builder, you can turn appraisal data into strategic, actionable intelligence—perfect for operational reviews, executive reporting, and continuous improvement.

Both borrowers and lenders/AMCs can initiate an ROV. Borrowers can submit requests directly through your portal, while lenders can act on their behalf when needed. ValueLink appraisal management software tracks the full workflow, automates notifications, and maintains an audit-ready trail. You can also fully customize the borrower-facing ROV experience—including disclosures, lender branding, and direct form links—to ensure clear communication and a seamless process.

Yes. You can upload a wide range of documents—such as AIR certifications, invoices, borrower acknowledgments, compliance certificates, credit card authorizations, SSRs (Fannie Mae, Freddie Mac), and even CrossCheck reports—at any stage of the order process. This ensures the appraiser has all the relevant context, helps reduce revision requests, and keeps the order fully documented for audit readiness.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.