Top 10 Things You Need To Know About a Real Estate Appraisal

Whether it’s buying a home or refinancing a mortgage, real estate appraisal is a necessity for any financed property. What is a real estate appraisal?

Built for reviewers who demand smarter compliance insights!

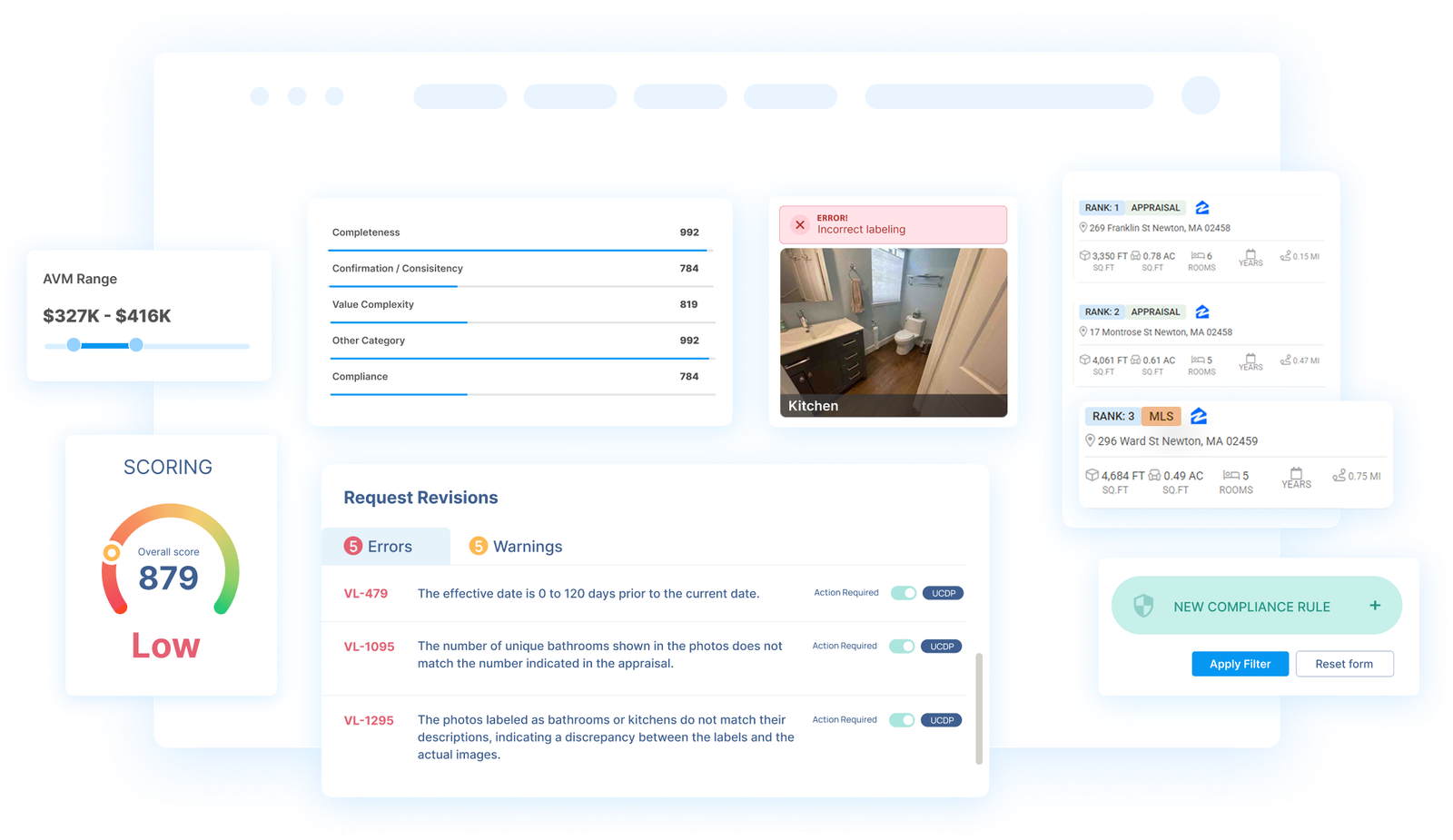

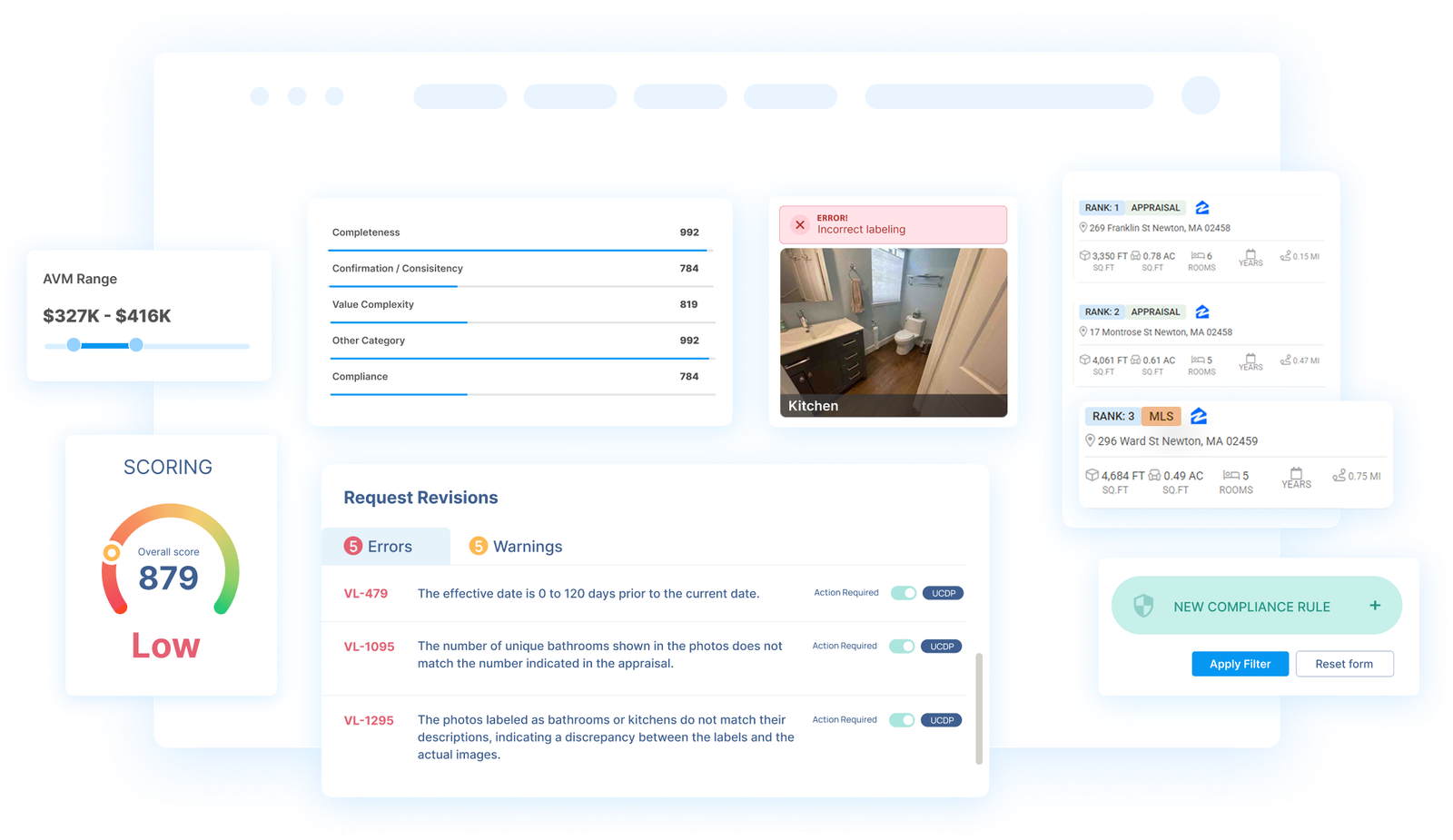

65%+ Faster Reviews with Real-Rime Risk Insights

95% U.S. Coverage Including Non-Disclosure States

Instant Decision-Ready Reports

Ensure accuracy and thoroughness with AI-Driven Scoring that actively checks report completeness.

Deliver precise valuations with AVM Confidence Score powered by predictive models for collateral risk.

Catch compliance issues early with Automated Risk Detection that checks for red flags before submission.

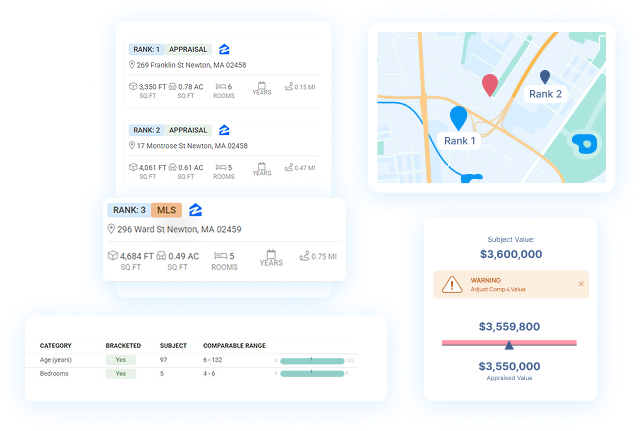

Access accurate property details instantly through Real-Time Multiple Listing Service (MLS) Data Integration.

Validate subject accuracy and fairness using Comps Adjustment Analysis and Bracketing.

Simplify comp comparisons with an Interactive Map View that visualizes proximity and relevance.

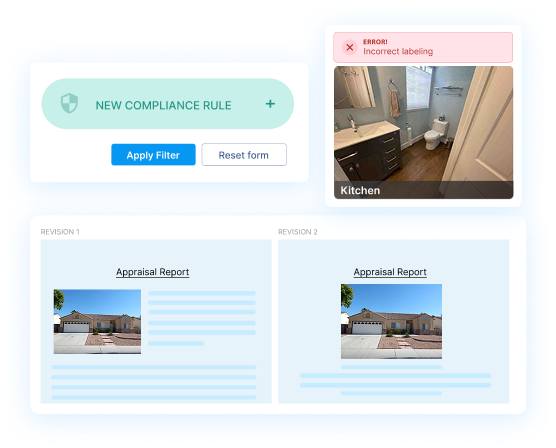

Adapt to your workflow and policies using the Custom Rule Builder.

Gain full transparency on revisions with Side-by-Side Report Comparison that tracks every change.

Save time and reduce errors through PDF Analysis and AI Photo Recognition that detects inconsistencies.

Prevent appraisal bias before submission with built-in Bias Detection that flags problematic language.

Ensure every appraisal meets compliance standards through a Dynamic Checklist with over 1000+ rules.

Stay audit-ready at all times with GSE Compliance Ready reports that meet regulatory standards at all times.

Source: 2025 Borrower insights survey

EDGE removes bottlenecks and accelerates approvals

EDGE minimizes review delays by auto-grading

Whether it’s buying a home or refinancing a mortgage, real estate appraisal is a necessity for any financed property. What is a real estate appraisal?

The manual workload of appraisal reviews is a time-consuming task, which restricts the number of appraisals a lender can review in any given day –

Scoring is a ValueLink proprietary mechanism assigned to each CrossCheck rule based on its impact on the report.

The AVM continuously gathers data from multiple sources in near real-time. A weekly process integrates the latest market data, ensuring that valuations reflect current market conditions.

Our Photo AI is trained on over 1 million real appraisal photos by a specialized third-party AI service, ensuring high accuracy and reliability.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.