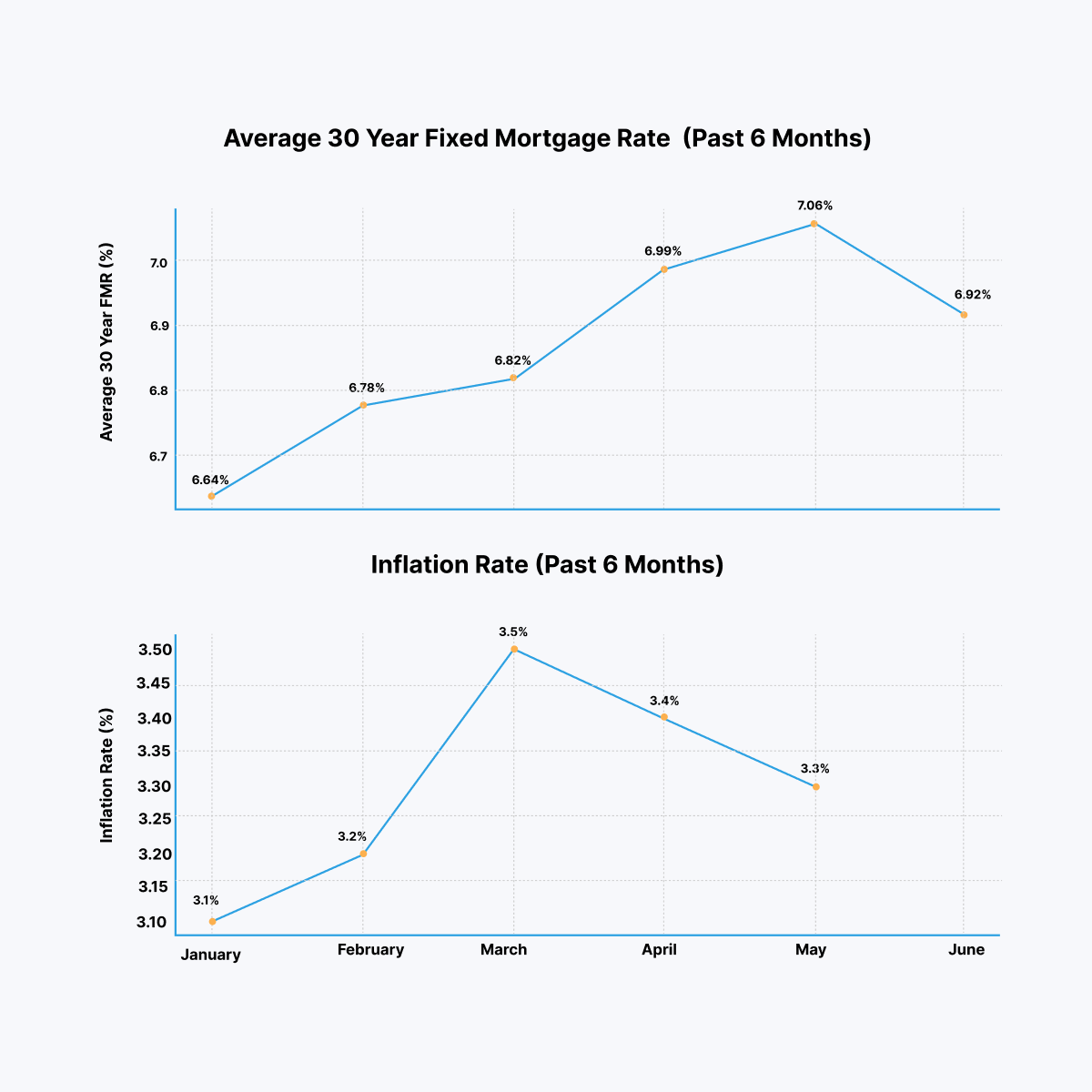

At the start of 2024, the market conditions pointed towards multiple rate cuts, with forecasts going up to three cuts throughout the year. However, the past 6 months saw the Federal Reserve maintaining a steady stance, neither hiking nor cutting rates. This cautious approach is primarily due to persistent inflation, which has proven more stubborn than initially expected (Freddie Mac). This resulted in the number of anticipated rate cuts going down from three to just one, contingent on significant improvements in inflation metrics. This has kept mortgage rates today relatively high, impacting housing affordability and borrower decisions between ARM vs. fixed-rate mortgages. Homebuyers and refinancers are now more cautious, analyzing the pros and cons of current 30-year mortgage rates today compared to other options.

Looking ahead, the outlook for the mortgage market remains closely tied to the Federal Reserve’s monetary policies. With only one potential rate cut now expected by year-end, the market will likely experience continued stability in mortgage rates, albeit at relatively high levels. Economic indicators will play a crucial role in determining the Fed’s actions. Still, recent statements from Fed officials suggest that even with signs of cooling inflation, the Fed may take a cautious approach before making any rate cuts. Interest rates today are a focal point for both lenders and borrowers, significantly affecting decisions around refinancing and new mortgage applications. Borrowers are especially keen to monitor whether the expected rate cut will materialize, impacting their decisions on locking in rates now or waiting for potentially better terms.

For mortgage lenders, the current environment highlights the need for agility and strategic planning. Here are some strategies to consider:

The mortgage market in 2024 presents unique challenges and opportunities for lenders. By focusing on strategic planning, leveraging technology, and staying informed about economic trends, lenders can navigate this uncertain period and capitalize on emerging opportunities. Embracing these strategies will help ensure that lenders meet the needs of borrowers and maintain a strong market presence. As mortgage rates and Fed rate hikes continue to influence the housing market, lenders who remain agile and well-prepared will be best positioned to succeed.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.