The mortgage industry is entering a new era.

With the pandemic refinance boom coming to an end and homebuyers facing the aftermath of a rate spike, the focus has shifted towards the purchase market, which offers ample opportunities for lenders to connect with homebuyers, increase their customer base, and drive ROI.

However, this requires a new approach and strategy that considers the high costs associated with the mortgage industry and leverages technology to drive efficiency.

Let’s delve into what the purchase market holds for lenders in 2023, examine the importance of homeowner communication and connection, discuss the challenges posed by high lender costs, and explore how technology can be harnessed to drive sales efficiency and reduce costs. By taking a proactive approach, mortgage lenders can navigate the changes in the market and emerge as the winners in 2023

For lenders, the past couple of years have been characterized by a single overarching theme: uncertainty. With such catalysts as the post-COVID refinance boom and inflation threatening prosperity on a global scale, lenders have had to adapt rapidly to meet changing market needs.

That said, not all is doom and gloom.

In our last blog on the current outlook of the housing market, we found that millennial first-time buyers entering the market in earnest will drive returning housing demand. As a result, in 2023, lenders must stop comparing 2022 volume and 2023 projections to the recorded refinance fundings from previous years.

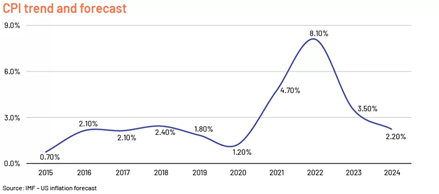

In reality, while the pandemic refinance boom is over, and home buyers are still absorbing this year’s rate spike, the worst of US inflation is likely over.

Three market factors set up the purchase market for smart lenders in 2023: rates are down, there will be 3.5 million mortgages made to homebuyers, and home sales have slowed, which has affected home price appreciation in some markets.

The 2023 purchase market is about connecting with homebuyers who need loans, showing them affordability, providing real-time rates and home price data, and keeping them confident as sellers become more willing to negotiate. Lenders need to support highly-experienced loan officers and find buyers and sellers listing their homes with a loan-to-value ratio of over 20%.

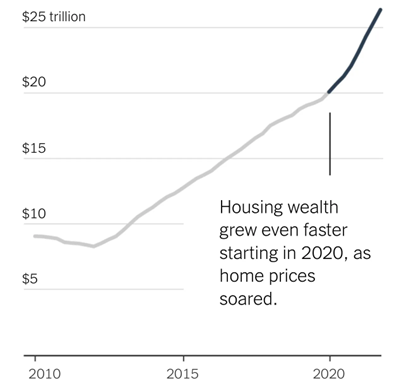

The American housing system holds a vast amount of tappable equity, estimated at $10.5 trillion, which presents an enormous opportunity for mortgage lenders. Connecting and communicating with homeowner customers is crucial in this market, as it helps build trust and strengthens relationships. By doing so, lenders can tap into this wealth of potential customers, expand their reach and increase their customer base.

For lenders, this means investing in customer engagement strategies and leveraging technology to reach homeowners in innovative and effective ways. Whether through targeted marketing campaigns, personalized communication, or utilizing advanced data analysis tools to better understand customer needs, the goal is to build a loyal and engaged customer base.

By focusing on homeowner communication and connection, lenders can not only increase their customer base but also create a more streamlined and efficient lending process. With a greater understanding of their customers’ financial needs and goals, lenders can provide more suitable loan options, streamline the application process, and ultimately provide a better overall customer experience.

The mortgage industry is facing a significant challenge in the form of high lender costs. The MBA reported that per-loan costs reached a record high of $11,016 in 3Q22, resulting in a net loss of $624 per loan. In an industry with margins as challenging as this, lenders must take measures to drive their ROI by facilitating their sales force.

Technology can help loan officers automate order assignments, inspection scheduling, and appraisal review by analyzing a customer’s financial data and presenting relevant options. This not only saves time and reduces costs, but it also strengthens the customer relationship by providing personalized and relevant loan options.

Additionally, technology can help lenders build strong partnerships and relationships within the industry, leading to increased business opportunities and cost savings. By automating manual processes, lenders can reduce the workload of sales personnel, freeing up their time to focus on more high-value activities, such as customer engagement and relationship building.

As the 2023 purchase market heats up, with cooling inflation, lower mortgage rates, and declining home prices, higher-cost salespeople will be in demand to help buyers navigate the market and make informed decisions.

A recent survey conducted by Moody’s Analytics showed that 56% of the bankers polled manual data collection and client back and forth as their biggest challenge in initiating the loan process. By automating loan origination systems (LOS), lenders can streamline manual processes, mitigate inaccuracies, and provide loan officers with the tools they need to work more efficiently.

An efficient loan management solution provides a range of benefits to lenders, streamlining and optimizing the loan application process.

Let’s quickly run this through a cost-benefit analysis; Freddie Mac estimates that mortgage companies implementing digital technology can operate at $2,200 less per loan, and have production cycles that are 5 days shorter. Integrating a workflow solution for the valuation process ensures lower processing times through parallel processing and optimal workflow distribution, resulting in quicker response times and improved product offerings for enhanced customer satisfaction.

In addition to improved accuracy in data entry and better management and tracking of documents, digitization also ensures effective compliance with regulatory requirements. The better audit trials and ability to track minute details result in a lower turnaround time, and the solution is equipped to handle fluctuations in loan volume with ease.

In this highly competitive mortgage industry, it’s essential for lenders to stay ahead of the curve and seize opportunities to drive growth and profitability. One of the main drivers of these high costs is the cost of sales personnel, which accounts for one-third of the per-loan cost. This is where technology can play a crucial role in reducing costs and making salespeople more impactful.

For over 12 years, ValueLink has paved the way for Lenders, AMCs, and Appraisers to streamline operations and automate the valuation process with our suite of one-window solutions. By leveraging ValueLink to drive sales efficiency, lenders can increase their competitiveness and drive ROI while reducing costs and building strong relationships with industry allies and partners.

ValueLink Direct, our dedicated valuation platform for Lenders, automates 95% of the appraisal process and simplifies panel management while ensuring regulatory compliance. Our appraisal vendor management software automates the entire appraisal ordering process, from order placement to report delivery. It is integrated with major Loan Origination Systems and offers advanced panel management options, ensuring compliance with AIR and Federal Regulations. With powerful order management features and reporting tools, users can make informed decisions in real-time. The software also prioritizes data security and performance for the protection of business and customer information.

If you’re looking to see how ValueLink empowers lenders to become trusted advisors for borrowers, learn more here or request a demo today.

© 2025 ValueLink and all related designs and logos are trademarks of ValueLink Software, a division of Spur Global Ventures Inc.