Blogs

Solutions

Featured Blogs 📖

Hybrid Appraisals: Faster, Smarter Property Valuations

In the current lending landscape, efficiency is everything. Traditional appraisals can create delays that slow down loan processing and impact borrower experience. As lenders push to streamline workflows and shorten turn times, hybrid appraisals are emerging as a practical solution

Meet Cogent – Now integrated with Core

Smarter Decisions. Stronger Margins. In the ever-evolving world of real estate valuations, appraisal management companies (AMCs) are constantly balancing speed, quality, compliance, and profitability. With growing regulatory scrutiny and increasing competition, making the right vendor fee decisions has never been

Prepare for the Encompass SDK Sunset: It’s Time to Transition to EPC

The Encompass SDK and legacy integrations are being retired on October 31, 2025. This shift affects a wide range of SDK-based applications and service ordering connections across the ICE Mortgage Technology ecosystem. Affected technologies include: Encompass SDK: Standalone modules and

Smarter, Faster Valuations with the ValueLink AVM Network

In today’s rapidly evolving real estate and mortgage landscape, access to fast, accurate property valuations is more critical than ever. Automated Valuation Models (AVMs) are helping lenders, investors, and appraisal management companies (AMCs) streamline decision-making, reduce costs, and manage risk

All Blogs 📖

ValueLink’s Recap of 2023

Introduction 2023 has had its ups and downs, filled with unforeseen challenges and unexpected opportunities. Yet, despite the uncertainties, we at ValueLink are proud to share that our steadfast commitment to adapting and enhancing our products has allowed us to

MBA Annual 2023: Recap and Key Takeaways

Last month, the Pennsylvania Convention Center witnessed a monumental gathering of mortgage experts at the Mortgage Bankers Association (MBA) Annual Convention and Expo. The pace of innovation has never been faster, and it’s all about breaking through the status quo.

Key Takeaways from The GSEs’ PDCIR and AIR Updates

The latest buzz in the industry revolves around the updates to the Appraiser Independence Requirements (AIR) and the introduction of the Property Data Collector Independence Requirements (PDCIR) by GSEs Fannie Mae and Freddie Mac. Issued in August 2023, these revisions

Paving the Way: Women Breaking Barriers in the Mortgage Industry

In an industry that has long been dominated by men, women are steadily breaking barriers and making significant strides in the world of mortgages. As we celebrate the accomplishments of trailblazers like Raveen Phifer, Business Development Manager at ValueLink, who

How Data is Revolutionizing Decision-Making for Lenders and AMCs

In today’s fast-paced business environment, Lenders and Appraisal Management Companies (AMCs) must stay ahead of the competition to succeed. Utilizing appraisal data in their decision-making can enable quicker and more accurate appraisal processes, reduce manual errors, and improve customer satisfaction.

Taco Tuesday – Raveen and Dalila discuss Appraisal Modernization

In a recent conversation with Dalila Ramos on Taco tuesday, ValueLink’s own Raveen Phifer discussed the latest tools and innovations in mortgage technology and appraisal. One of the key takeaways from their discussion was the importance of modernizing the appraisal

5 Reasons Automated Workflows Are Important For AMCs

In today’s fast-paced business environment, the importance of automation and organized workflows cannot be overstated for Appraisal Management Companies. With 76% of businesses using automation for standardizing or automating daily workflow adapting to automation can lead to many benefits for

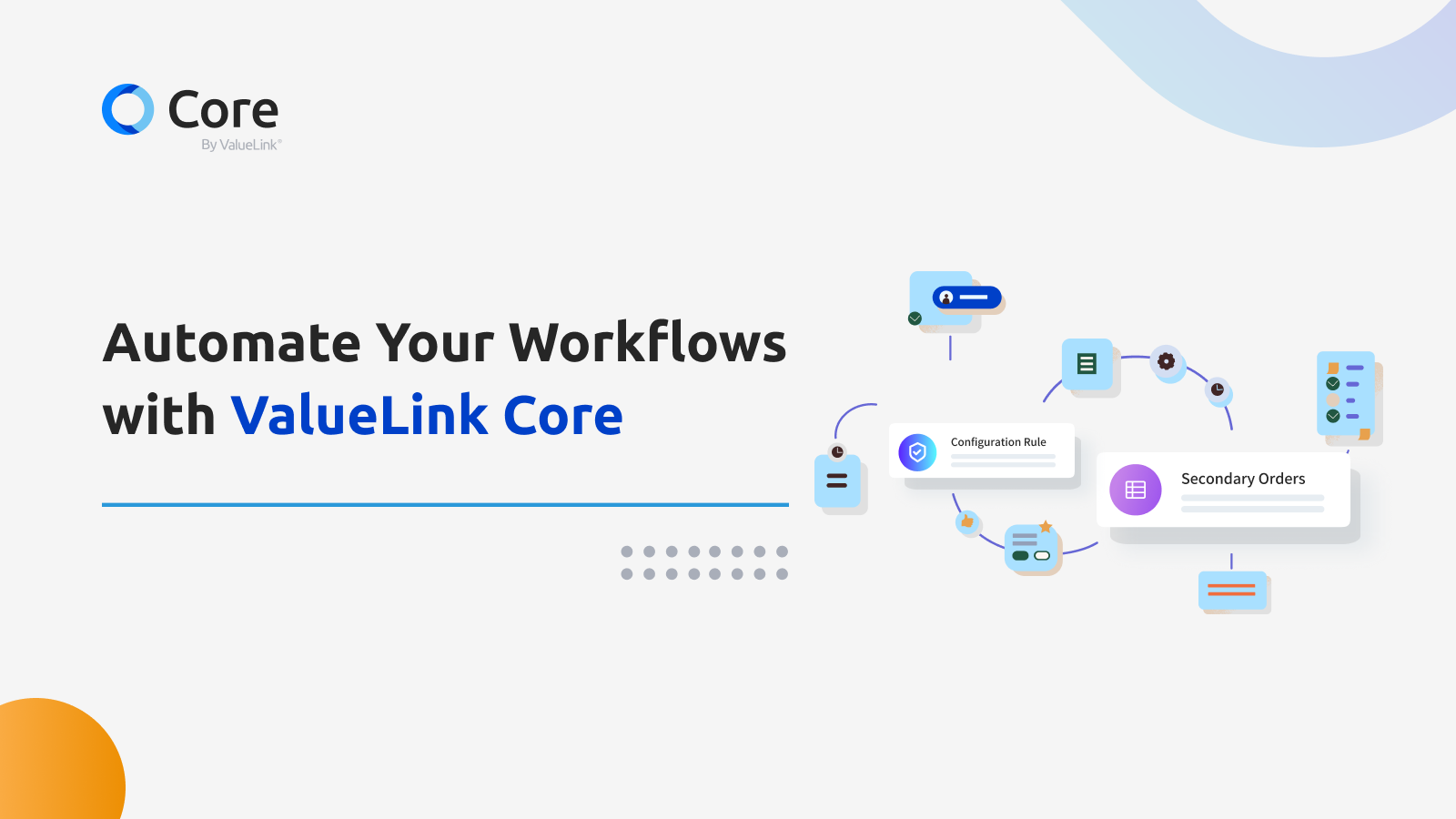

Automate Your Workflows with ValueLink Core

Appraisal management companies deal with some of the most overly complex tasks. Outdated processes & technologies add unnecessary hurdles that result in manual entries and high turnaround times. ValueLink Core enables AMCs to streamline their appraisal processes by automatically assigning

Appraisal Modernization – ValueLink x Clear Capital

The need to adopt innovative solutions cannot be overstated for Lenders and AMCs, and one such solution is the modernization of appraisals in the loan origination process. Appraisal modernization aims to enhance appraisers’ productivity by eliminating the need to collect

Value Acceptance + Property Data Program for Lenders

In today’s fast-paced world, lenders need to stay competitive by embracing innovative solutions. Appraisal modernization is an essential aspect of the loan origination process that can make a world of difference. With the Value Acceptance + Property Data program, Fannie

What The 30 BPS MIP Cut Means for The Housing Industry

The mortgage industry breathed a sigh of relief as The Federal Housing Administration (FHA) recently announced a 30 basis point reduction in its annual Mortgage Insurance Premium (MIP) rates. This reduction is expected to save homebuyers an average of $900

ValueLink Secures Name on HousingWire’s Tech100 Mortgage Honoree List

ValueLink Software, a leading provider of innovative solutions for the real estate valuation process, has been recognized as one of the 2023 HousingWire TECH100 Mortgage Honorees. The TECH100 program is an annual list of the most impactful and innovative companies in