The mortgage industry breathed a sigh of relief as The Federal Housing Administration (FHA) recently announced a 30 basis point reduction in its annual Mortgage Insurance Premium (MIP) rates.

This reduction is expected to save homebuyers an average of $900 annually and is aimed at making homeownership more affordable for more Americans.

In a nutshell, it means buying a home just got more affordable!

While this is undoubtedly good news for homebuyers, what does this mean for the industry? Let’s dive in:

The Rundown: Understanding MIP

Mortgage Insurance Premium is a fee that borrowers pay to the FHA to protect lenders in case the borrower defaults on their mortgage. This fee is usually added to the monthly mortgage payment and is based on the property’s loan amount and the loan-to-value ratio (LTV). The MIP rates are set by the FHA and are subject to change.

Impact on Homebuyers

Support from Mortgage Trade Groups

The move has been widely welcomed by mortgage trade groups, which have advocated for an MIP cut for years. The Mortgage Bankers Association, in particular, expressed its support for the move, noting that it would expand homeownership opportunities by lowering mortgage payments for qualified FHA borrowers.

Concerns from Mortgage Analysts

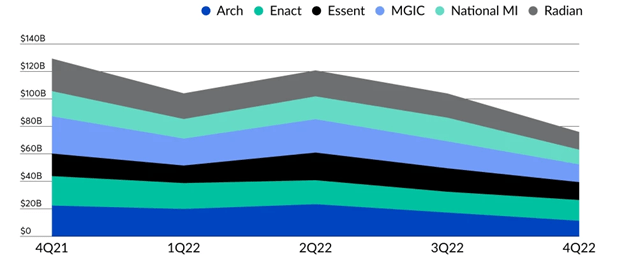

While the MIP cut has been welcomed by many, some mortgage analysts question its potential impact. In a note ahead of the expected announcement, Bose George, an analyst at Keefe Bruyette Woods, stated that a cut of that size would have minimal effects in terms of moving shares from the mortgage insurers (MIs) to the FHA. Furthermore, the Federal Housing Finance Agency (FHFA) announced cuts to GSE fees to higher-risk borrowers in October 2022, which could have shifted some volume from the FHA to the MIs.

Despite these concerns, the FHA’s Mutual Mortgage Insurance Fund reported a capital ratio of 11.11% in November, well above the statutory minimum of 2.0%. This suggests that the FHA is well-capitalized and can afford to make this move.

Impact on the Valuation Industry

The MIP reduction may make FHA loans more attractive to homebuyers looking for lower down payment options and more flexible credit requirements. This will, in turn, drive demand for FHA appraisals, requiring appraisers to be more familiar with FHA requirements and guidelines.

Imminent Increase in Appraisal Orders

Pressure to Keep Appraisal Values Low

That said, appraisers may also face pressure to keep their appraisal values low to meet the needs of homebuyers looking for more affordable homes. This could lead to increased appraisal challenges and requests for revisions, which can be time-consuming and may impact appraisers’ productivity.

The Next Step for Lenders, AMCs, Appraisers

The reduction in FHA MIP rates is expected to significantly impact the housing market, making homeownership more affordable and accessible for more Americans. While there are some concerns about the move’s impact on the mortgage market, it is widely welcomed as a step in the right direction. Ultimately, the program’s cost is estimated to be around $678 million in the first year of the new pricing, making it a considerable investment in the American dream of homeownership.

The MIP reduction is expected to have significant impacts on lenders, as they play a crucial role in the FHA loan process. Lenders offering FHA loans are likely to benefit from the MIP cut, as it may make these loans more attractive to borrowers, leading to an increase in demand. However, lenders must consider adjusting their pricing and underwriting guidelines to account for the lower MIP rates while ensuring that they comply with FHA regulations and guidelines.

With greater demand for refinances and home purchases imminent, appraisers can make the most of this development by partnering with a modern, unified platform that streamlines their entire workflow, increases credibility, and helps them reach out to more lenders and AMCs.

The MIP reduction is also likely to impact AMCs, who will see an increase in appraisal orders for FHA loans. They must be prepared to adjust their pricing and turnaround times to accommodate this rising demand while ensuring that they maintain their high appraisal quality standards.

With the ability to connect to over 150 Lenders, 250 AMCs, and 40,000 Appraisers, ValueLink’s suite of versatile workflow solutions automates every step of the valuation process so they can expedite orders and minimize revisions.

To learn how ValueLink empowers Lenders, AMCs, and Appraisers with automated order management with better turn times, learn more here or request a demo today.